Insurance claims process sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

When it comes to dealing with insurance claims, understanding the process is key to ensuring a smooth and successful outcome. From defining what an insurance claim is to exploring the role of technology in streamlining claims, this topic delves into the complexities and nuances of navigating the world of insurance.

Overview of Insurance Claims Process

An insurance claim is a formal request made by a policyholder to an insurance company for coverage or compensation for a covered loss or policy event. It is an essential part of the insurance process as it allows individuals to recover financially from unforeseen events or damages.

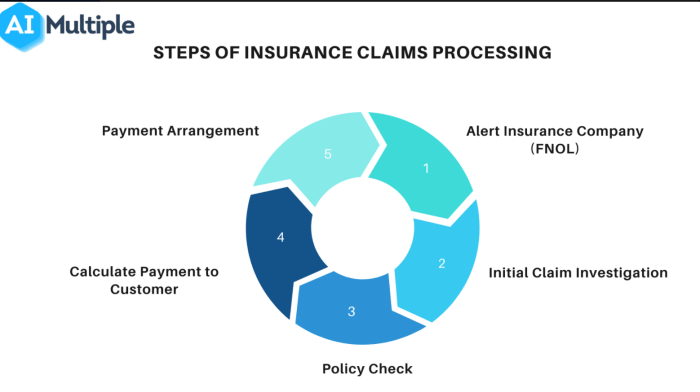

Key Steps in the Insurance Claims Process

- Report the Claim: The insured individual must notify the insurance company about the incident or loss that occurred.

- Claim Investigation: The insurance company will investigate the claim to determine its validity and coverage.

- Evaluation of Damages: An adjuster will assess the damages and determine the amount of compensation owed.

- Negotiation: The insured and the insurance company may negotiate the final settlement amount.

- Settlement: Once an agreement is reached, the insurance company will provide the compensation to the insured.

Parties Involved in an Insurance Claim

- Insurer: The insurance company that provides coverage and processes claims.

- Insured: The individual or entity that holds the insurance policy and files the claim.

- Adjuster: A representative of the insurance company who assesses the damages and negotiates the settlement.

- Third Parties: Individuals or entities involved in the incident who may also be part of the claim process.

Types of Insurance Claims: Insurance Claims Process

Insurance claims can vary depending on the type of coverage you have. Here are some common types of insurance claims and the process for each:

Auto Insurance Claims

When you get into a car accident or your vehicle gets damaged, you can file an auto insurance claim. You will need to gather information such as the other party’s insurance details, police report, and photos of the damage. Your insurance company will then assess the damage and provide coverage based on your policy.

Health Insurance Claims

Health insurance claims are typically filed when you receive medical treatment or services. You will need to submit a claim form along with any medical bills or receipts. Your insurance company will review the claim and determine the coverage based on your policy.

Property Insurance Claims

Property insurance claims are common for incidents like fire damage, theft, or natural disasters. You will need to document the damage, provide estimates for repairs or replacements, and submit a claim to your insurance company. They will assess the damage and provide coverage based on your policy.

Examples of scenarios that may lead to different types of insurance claims include a car accident for auto insurance, a medical emergency for health insurance, and a house fire for property insurance. Each type of claim has its own process and requirements, so it’s important to understand the specifics of your policy to ensure a smooth claims process.

Documentation Required for Filing an Insurance Claim

When filing an insurance claim, having the right documentation is crucial for a smooth and efficient process. Proper documentation helps ensure that your claim is processed quickly and accurately, allowing you to receive the compensation you deserve.

Essential Documents for Filing an Insurance Claim

- Policy Information: Your insurance policy details, including the policy number, coverage limits, and effective dates.

- Claim Form: A completed claim form provided by your insurance company.

- Proof of Loss: Documentation supporting your claim, such as receipts, invoices, or estimates for damages.

- Police Report: In case of theft, vandalism, or accidents, a copy of the police report is required.

- Photos and Videos: Visual evidence of the damage or loss to support your claim.

- Medical Records: For health insurance claims, medical records and bills related to the treatment received.

Importance of Proper Documentation

Proper documentation plays a vital role in expediting the insurance claims process. By providing all the necessary documents upfront, you can help the insurance company assess the validity of your claim more efficiently. This can lead to a faster resolution and quicker payment of your claim.

Consequences of Inadequate Documentation

Inadequate or missing documentation can result in delays or denials of your insurance claim. Without proper evidence to support your claim, the insurance company may have difficulty verifying the validity of your losses. This can lead to extended processing times, additional requests for information, or even rejection of your claim altogether. Therefore, it is essential to ensure that you have all the necessary documentation in place when filing an insurance claim.

Role of Technology in Streamlining Insurance Claims

Technology plays a crucial role in transforming the insurance claims process, making it more efficient and accurate. The use of AI and blockchain in the insurance industry has revolutionized how claims are handled, leading to faster processing times and reduced errors.

AI in Claims Processing, Insurance claims process

Artificial Intelligence (AI) is being used to automate repetitive tasks in claims processing, such as data entry and assessment. AI algorithms can analyze large amounts of data quickly and accurately, helping insurance companies expedite claim settlements and improve customer satisfaction.

Blockchain in Claims Management

Blockchain technology is used to create secure and transparent records of insurance claims. By storing claim information in a decentralized database, insurers can reduce fraud and ensure the integrity of claim data. This technology also enables faster verification of claims and eliminates the need for manual paperwork.

Benefits and Challenges of Integrating Technology

- Benefits:

- Increased efficiency in claims processing

- Improved accuracy in claim assessment

- Enhanced fraud detection and prevention

- Streamlined communication between insurers and policyholders

- Challenges:

- Initial investment costs for implementing new technology

- Data privacy and security concerns

- Integration with existing systems and processes

- Training employees to use new technology effectively

Common Delays and Challenges in Insurance Claims Processing

When it comes to processing insurance claims, there are several common delays and challenges that can arise, impacting both insurers and claimants. Understanding these issues is crucial in order to improve the efficiency of the claims process.

Reasons for Delays in Processing Insurance Claims

- Insufficient Documentation: One of the main reasons for delays in processing insurance claims is the lack of proper documentation provided by the claimant. Without all the necessary paperwork, insurers may not be able to assess the claim accurately.

- Complex Claims: Claims that involve multiple parties, intricate details, or special circumstances can result in delays as they require more time to investigate and evaluate.

- Disputes and Investigations: Disputes between the insurer and the claimant, or the need for further investigations into the claim, can lead to delays in processing as both parties work to resolve the issues.

Challenges Faced by Insurers, Claimants, and Adjusters

- Communication Issues: Poor communication between insurers, claimants, and adjusters can hinder the claims process, leading to misunderstandings and delays.

- Resource Constraints: Insufficient resources, such as manpower or technology, can pose challenges for insurers in processing claims efficiently.

- Regulatory Compliance: Adhering to strict regulatory requirements and compliance standards can add complexity to the claims process and cause delays.

Strategies to Overcome Delays and Improve Efficiency

- Enhanced Technology: Implementing advanced technology solutions, such as automation and digital tools, can streamline the claims process and reduce delays.

- Clear Communication Channels: Establishing clear communication channels between insurers, claimants, and adjusters can help in resolving issues quickly and efficiently.

- Training and Development: Providing ongoing training and development opportunities for adjusters and staff can improve their skills and ensure a smoother claims process.