Embark on a journey through the loan approval process, where each stage unfolds like a plot twist in a high school hip novel, revealing the secrets to unlocking financial opportunities.

From understanding the stages to navigating credit checks, this narrative will guide you through the intricacies of securing loan approval.

Overview of Loan Approval Process

When applying for a loan, there are several stages involved in the approval process. Lenders carefully assess various factors to determine if an applicant qualifies for the loan.

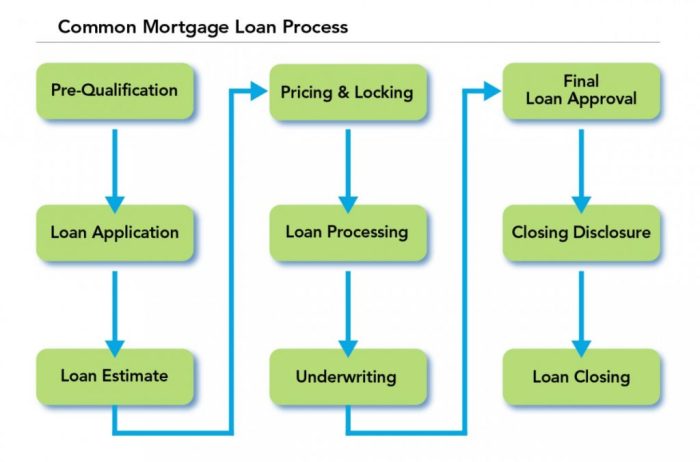

Stages Involved in Loan Approval Process

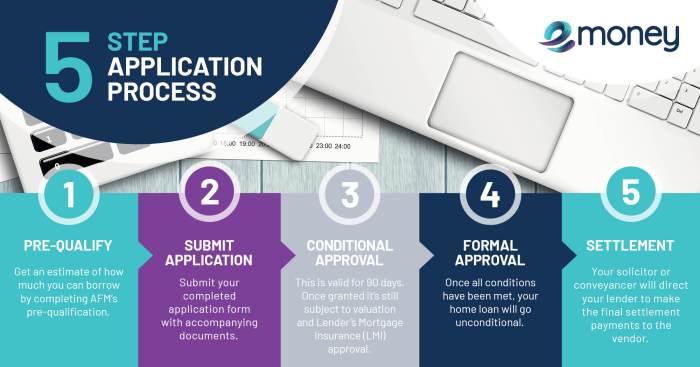

- Application Submission: The first step is submitting a loan application with all required documents and information.

- Review and Verification: Lenders review the application, verify the information provided, and assess the applicant’s creditworthiness.

- Approval Decision: Based on the evaluation, the lender decides whether to approve or deny the loan application.

- Loan Disbursement: If approved, the loan amount is disbursed to the borrower as per the terms and conditions.

Key Factors Considered by Lenders

Lenders consider several key factors during the approval process to determine the applicant’s creditworthiness and ability to repay the loan. These factors include:

- Credit Score: A higher credit score indicates a lower credit risk for the lender.

- Income Stability: Lenders assess the applicant’s income stability to ensure they can meet the repayment obligations.

- Debt-to-Income Ratio: The ratio of an applicant’s monthly debt payments to their income is crucial in determining their ability to manage additional debt.

Importance of Credit History and Income Verification

Credit history and income verification play a vital role in the loan approval process. A positive credit history demonstrates responsible financial behavior, while income verification ensures the applicant has the means to repay the loan. Lenders rely on these factors to mitigate the risk of default and make informed lending decisions.

Application Submission

When it comes to submitting a loan application, there are specific steps you need to follow to ensure a smooth process. Additionally, the documentation required plays a crucial role in determining the approval of your loan. With the advancement of technology, online applications have made the submission process more convenient and efficient.

Steps Involved in Submitting a Loan Application

- Fill out the application form accurately with all the required information.

- Gather necessary documentation such as proof of income, identification, and credit history.

- Submit the application along with the required documents to the lender.

- Wait for the lender to review your application and make a decision.

Documentation Required for a Loan Application

- Proof of income: Pay stubs, tax returns, or bank statements.

- Identification: Driver’s license, passport, or any government-issued ID.

- Credit history: Credit report showing your credit score and payment history.

- Additional documents: Depending on the type of loan, you may need additional documents such as proof of assets or employment verification.

How Online Applications Have Simplified the Submission Process

- Convenience: You can fill out the application from the comfort of your home at any time.

- Speed: Online applications are processed faster compared to traditional paper applications.

- Accuracy: Online forms often have built-in checks to ensure all required information is provided, reducing the chances of errors.

- Accessibility: Online applications allow you to easily track the status of your application and communicate with the lender electronically.

Credit Check and Verification

When applying for a loan, one crucial step in the approval process is the credit check and verification. This process helps lenders assess the creditworthiness of applicants and determine their ability to repay the loan.

Role of Credit Checks

- Credit checks provide lenders with a snapshot of an applicant’s credit history, including their credit score, payment history, and outstanding debts.

- Lenders use this information to evaluate the risk of lending money to an individual and determine the terms of the loan, such as the interest rate.

- Applicants with a higher credit score are more likely to be approved for a loan and may receive better loan terms, while those with a lower credit score may face challenges in getting approved.

Verification Process

- Lenders verify the information provided by applicants, such as income, employment status, and assets, to ensure the accuracy of the application.

- This verification process may involve contacting employers, reviewing bank statements, and requesting additional documentation from the applicant.

- By verifying the information, lenders can confirm the applicant’s ability to repay the loan and reduce the risk of default.

Importance of Accurate Information, Loan approval process

- Accurate information is crucial during the verification process as it helps lenders make informed decisions about approving a loan.

- Providing false or misleading information can lead to the rejection of the loan application and may damage the applicant’s credit profile.

- It is important for applicants to be transparent and truthful when providing information to ensure a smooth verification process and increase their chances of loan approval.

Approval or Rejection

When it comes to loan approval or rejection, there are specific criteria that lenders consider to make their decision. These criteria play a crucial role in determining whether an individual’s loan application gets approved or rejected.

Criteria for Loan Approval or Rejection

- Income: Lenders assess an applicant’s income to determine their ability to repay the loan. A higher income usually increases the chances of approval.

- Credit History: A strong credit history reflects responsible borrowing behavior and increases the likelihood of approval.

- Debt-to-Income Ratio: Lenders evaluate the ratio of an applicant’s debt to their income. A lower ratio is favorable for approval.

- Employment Status: Stable employment is essential as it indicates a reliable source of income for loan repayment.

Common Reasons for Loan Rejections

- Low Credit Score: A poor credit score can lead to rejection as it indicates a higher risk for the lender.

- Insufficient Income: If an applicant’s income is not deemed sufficient to cover the loan payments, the application may be rejected.

- High Debt Levels: Excessive existing debt can raise concerns about an individual’s ability to manage additional debt, leading to rejection.

- Unstable Employment: Frequent job changes or unemployment can make lenders hesitant to approve a loan.

Impact of Credit Score on Approval Decision

A credit score is a significant factor in the loan approval decision. It provides lenders with an indication of an individual’s creditworthiness and financial responsibility. A higher credit score typically improves the chances of loan approval, as it demonstrates a history of timely payments and responsible financial behavior. On the other hand, a low credit score can result in rejection or approval with higher interest rates to offset the perceived risk.

Conditional Approval and Closing: Loan Approval Process

When it comes to the loan approval process, conditional approval plays a crucial role in determining the final steps before the funds are disbursed. Let’s dive into what conditional approval entails and the subsequent closing process.

Conditional Approval Process

- During conditional approval, the lender reviews all necessary documentation provided by the applicant to ensure that all requirements are met.

- Any outstanding conditions, such as additional proof of income or employment verification, must be fulfilled before final approval can be granted.

- Once all conditions are satisfied, the loan moves to the final approval stage.

Final Approval and Closing Process

- Once the loan receives final approval, the closing process begins. This involves signing the necessary paperwork and finalizing the details of the loan.

- During closing, the borrower may be required to pay closing costs and fees associated with the loan.

- After all documents are signed and funds are disbursed, the loan is considered closed, and the borrower is officially responsible for repaying the loan amount.

Timeline from Approval to Disbursement

It typically takes a few days to a few weeks from final approval to the disbursement of funds, depending on the lender and the type of loan.

- After final approval, the lender processes the loan and prepares to release the funds to the borrower.

- The disbursement timeline can vary based on factors such as the method of payment chosen by the borrower and any additional processing requirements.

- Once the funds are disbursed, the borrower can start using the loan amount for the intended purpose, whether it’s for a home purchase, car loan, or personal expenses.